Helping Close The Gap

By Sophia Schmidt

Take a moment and think back to your elementary and middle-school days. Is there ever a time where you find yourself saying, "Wow, I wish I would've learned that back then?” Maybe it was something like a second language, cooking skills, or learning how to prepare for a job interview? One of the subjects finding itself atop many lists of reflecting adults is that of finances; taxes, stocks, credit scores, and a multitude of other hair-raising terms. How much more beneficial would it have been to understand these things as a young person rather than stumbling through them as an adult?

“I get numbers more than I do the alphabet.”

Shaquandra Jamison has witnessed many unnecessary financial setbacks for adults. She's also learned from those thriving through life all because they understand the fundamentals of money. Because of this, Shaquandra decided to venture further into financial literacy. Ms. Jamison is currently spending most of her professional moments as an accountant for celebrities in the Los Angeles area. She's also dedicated herself to providing a resource for children that is easy to understand and apply. Her hope is that accounting will spark curiosity and preparedness throughout their lives. She believes setting a foundation of financial literacy in adolescence will benefit youth as they grow. “Once they become adults, they will be better at adulting,” says Shaquandra.

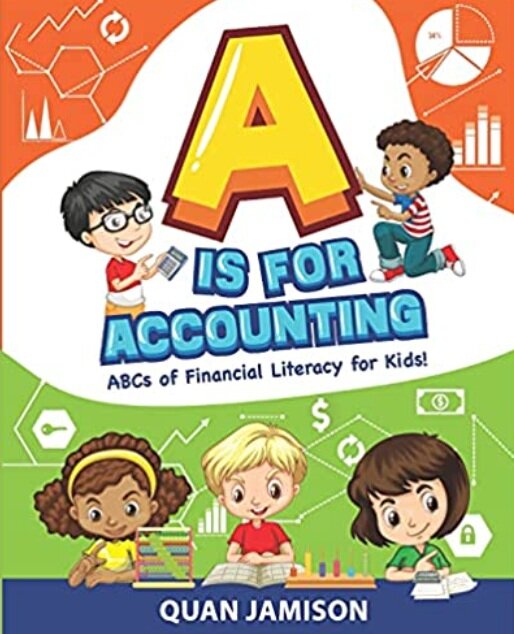

With over 15 years of experience in the industry, Shaquandra had no choice but to become well-versed in successful financial adulting. How was she able to pivot into an informative children’s book? Well, it began with her 8-year-old daughter, also seen as her muse. Jamison homeschooled her daughter for several years and diligently included subjects often left out of traditional schooling. Shaquandra prioritized physical wellness and finances above the general topics presented in early childhood education. As an exercise and as an opportunity to spread the knowledge, Shaquandra and her daughter began composing videos explaining different financial concepts and posting them on social media. Parents were excited and reached out for more content, leading Shaquandra to write and publish her first book, “A is For Accounting.”

Shaquandra's journey toward writing a guide to finances for children was no small feat. “I get numbers more than I do the alphabet,” Shaquandra joked. However, the challenge went beyond the act of writing. Taking complex subjects and making them digestible for children was the real challenge. Navigating this territory was made much easier through the collaborative efforts of Shaquandra and her daughter. After all, if an 8-year-old can understand the material, the target audience has been reached. In an attempt to make this book understandable for children, Shaquandra knew the content would have to be relatable. She's accomplished that for sure.

“A is For Accounting” features numerous examples of children of various shades making monetary-focused business decisions (including a young girl with a cupcake company). Multitudes of children want to start companies of their own, empowered even more through the ability to see themselves in the characters they're reading about. An amazing accomplishment like this will assist young entrepreneurs with finding their passion while understanding the financial side. "Finance transcends all colors,” remarked Ms. Jamison, “everyone has to acknowledge it”, recalling the famous and often, hard to swallow quote, “Nothing in life is certain except death and taxes.”

Shaquandra has decided to team up with Brandon Publishing and join the Closing The Gap initiative. Financial literacy is very important to our communities and their sustainability. "A is For Accounting," will be handed out to students (for free) in several Michigan communities starting this fall. She has also recently released another title, “Playing With Plastic,” Credit Card Lessons for Kids. You can engage and purchase these wonderful works by clicking here. *SS